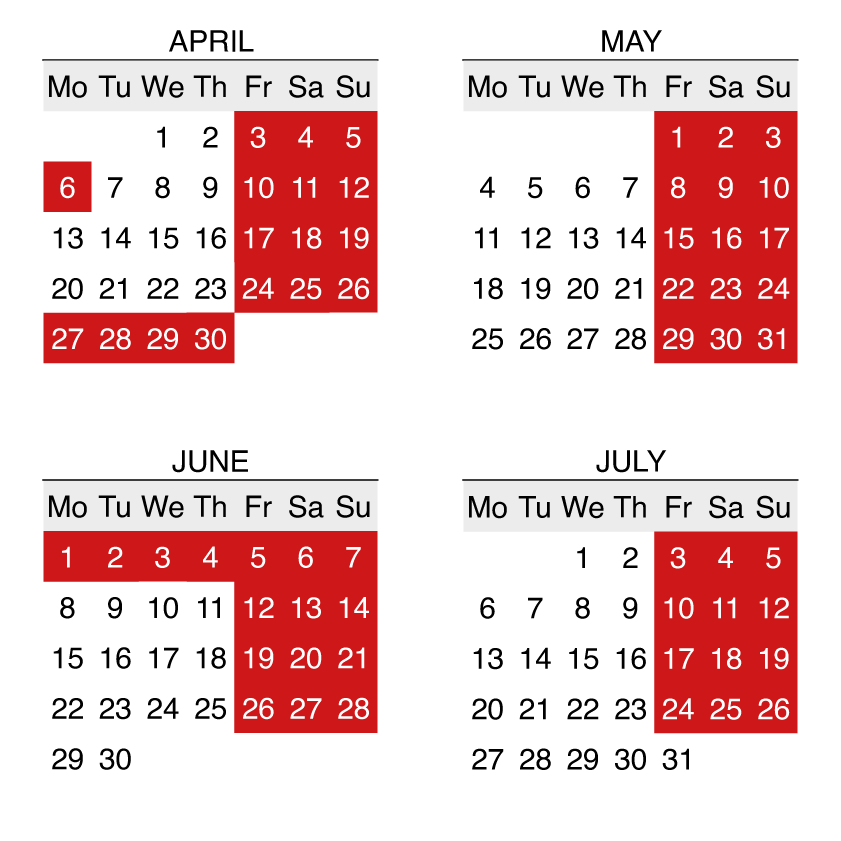

Please note that the FAQs (Frequently Asked Questions) regarding the application of the Access Fee for the year 2026 are currently unavailable. They will be published as soon as the official documents governing the management of the 2026 trial contribution are approved. Please also note that the dates on which the Access Contribution will be required for the year 2026 are as follows: